Keeping the Score: How to Track Vendor Performance

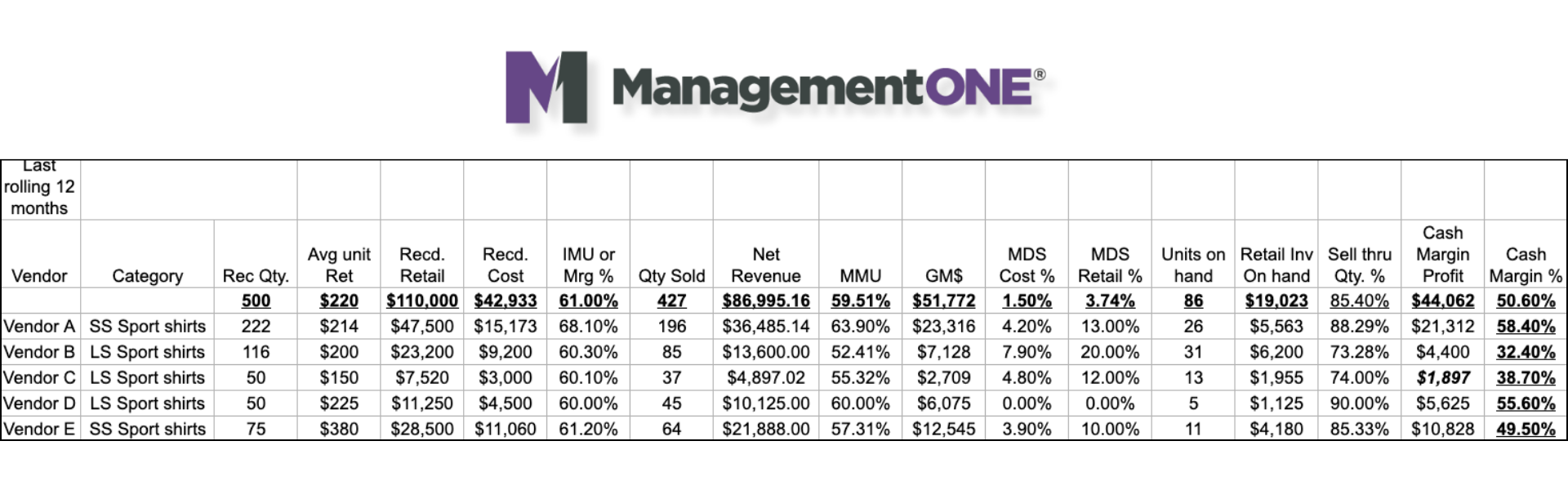

A scorecard is a tool that helps businesses measure and improve their performance. A vendor scorecard tracks the performance of your vendors over a period of time. A scorecard typically consists of a set of goals, indicators, targets and actions that enables buyers to make decisions on future buys based on past performance.

A scorecard can help businesses track their progress, identify gaps and opportunities, provide insight, knowledge, and communicate their results to stakeholders like your vendors. A scorecard can also motivate and empower buyers to take ownership of their work and enhance their contributions to the business success. One critical scorecard, especially valuable during buying periods, is the vendor scorecard.

Here are the elements of a good vendor scorecard:

Analyzed by classification by vendor. Not all vendors are strong in all classifications when vendors are not singular in a specific category or class.

Enough metrics to have a full understanding. For example, Cash margin and gross margin can be different, when markdowns are not taken into account, or inventory is not stated and reduced to its current effective value.

Don’t forget color. An item might be strong in one, or several colors. If you look at a style and the overall sell through that was average, take a deeper dive. What does it look like when you analyze by color? It might tell a different story.

Allows you to cull the herd. It is important to play to your strengths and your vendors’. One of the biggest mistakes retailers make is being over assorted. That means too many vendors and too many styles within a classification.

A baseline for measuring and evaluating your buyer’s perfromance. Where did we succeed, where can we do better? This is important for coaching and compensation considerations, including performance based pay.

Negotiate with your vendors. Don’t be shy about sharing. If the report is not good, it is not a reflection of you, it is how your customers voted. Ask for markdown money or assistance on a future buy. Don’t be afraid to be creative. Ask for trunk shows and marketing dollars. Ask your vendors to share in the growth, they get it back in future orders if they partner in your success.

Be strategic- The results tell you a great deal and should open the door to ask more questions. Business is fluid and changing. A key vendor may not be as important as in the past, are there emerging vendors and classifications?

Run it over a specific period. I tend to default to a rolling 12 month period. That covers more than one season and goods are sold between peak seasons so you get a good overall response.The data has less bias and the period of time is consequential.

Compare results to a comparable period. Provides insights to changes and perhaps different decisions that were made between periods.

Share with your Inventory expert. If you use M1, they are a great sounding board as they have a wider view of the business. They will also be objective.

Do not be afraid of the results. Scorecards are report cards for some may attach emotionally, a lingering fear, associated with these kinds of reports.Treat them as a friend to help you make better decisions. Mistakes and failure are part of how we learn and grow.That is what initially attracted me to retail. The ability to change on Tuesday the mistakes I made on Monday, or change the buy I made for this season based on what I learned from what went well and not so well in the current season.

During covid I created the Vendor Scorecard. The sole purpose at that time was to use the tool to negotiate with vendors. That is still a good strategy. The spreadsheet has a greater purpose especially now as you are full into the buying cycle.

There are a lot of metrics but they all tell a story. Individually they can be misleading but together they are impactful. Vendor C had a good sell through, a good maintained margin, but a lousy cash margin. Do we need it? Had we bought deeper, would the results have been better or even worse? What if they had taken those dollars and invested in Vendor D? Vendor B had a good sell through but was driven by markdowns and still has the largest quantity left in units. The point of a scorecard is to analyze and ask questions.

Here is a link to the scorecard. Most if not all the information is available in your POS system and from M1 reporting. I would encourage you to do the work to build these reports. Once built you can save them and generate them on demand.

If you cannot collect all this information, at least look at what you started with, what you received at cost and retail, and what you have left. It is a down and dirty method, but will still provide you with critical knowledge.

If you have any questions feel free to contact your M1 Retail Expert, or support@management-one.com and we are happy to provide you with assistance.

Onwards and Upwards,

Marc Weiss

Co-Founder - Management One