September: Why it is the most significant month of the year.

“Marc, do you know why September is the most important month of the year?”

I will never forget that question or many of the other conversations I had with Page Keel. Page was with Management One as a consultant to over 30 Indie retailers. He was also a mentor who unfortunately died of an aggressive form of pancreatic cancer in 2006. He studied his clients and their data, always looking for opportunities and always analyzing losses. He almost always played offense and on the rare occasion he didn’t, he swiftly changed course. He helped validate my philosophy on playing offense. Some of our most successful retailers today were originally clients of Page Keel. He was a great teacher who knew how to guide his clients using their data, while challenging and encouraging them to the next level. Page said to me:

“September is the most important cash flow planning month of the year. The cash you have, or don’t have on December 31st is determined from what decisions you make in September, and implement as the season goes forward.”

Though not an exact quote, it is the essence of his guidance, and to this day those words still remain in my memory of him and his distinctive southern drawl.

Over the years, in my own practice, I found this to be true. September became the most definitive month for cash flow planning. The goal was to set a cash target for the close of business on December 31st. Every year we looked at how we did in achieving that number. Every meeting throughout the period was to make decisions to hit that number.

In that exercise, I also worked at creating special Q4 goals for all staff, both selling and non-selling. Those practices created good habits not just for Q4 but carried forward throughout the year. Establishing (and ultimately reaching) any goal requires a team effort, and participation helps achieve those results. Hitting or surpassing the goal provides an opportunity to reward for the efforts.

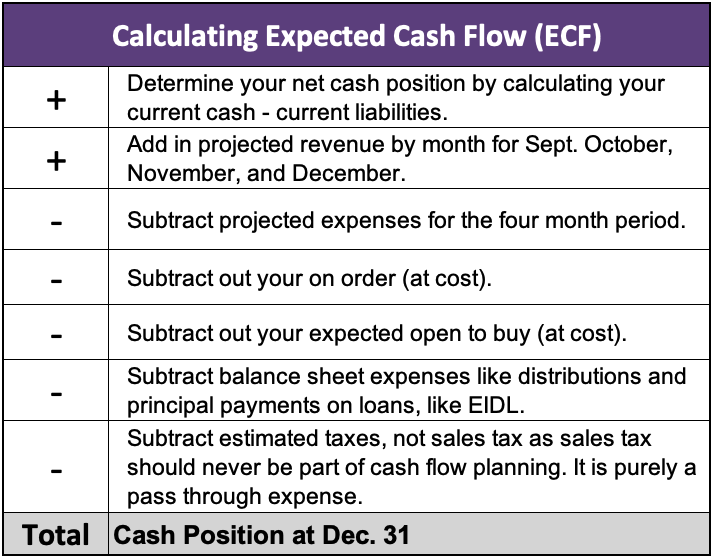

Here is a simple way to get started:

Now that you know your Expected Cash Flow you can begin to strategize and make decisions. Every decision you make must answer the question, will this help or hurt my ability to reach that ECF number? Knowing this helps you decide on reorders, cancellations, marketing, events, compensation, presentation, markdowns, hiring, firing, and truly every lever you can pull as we head into the home stretch.

Wishing you all a great finish to 2023. Indie retail is robust and growing. The #1 thing you can do is focus, focus, focus on your people and your revenue.

Please add your comments below. If you would like to schedule a meeting to discuss this metric and how to apply it to your business, here is a link to my calendar or contact Management One for more information.

Onwards, and Upwards,

Marc Weiss - Co-founder, Management One